Your deposit must be “externally sourced funds,” meaning they come from a source not affiliated with Capital One.Ĭapital One 360 Checking Account Account Bonus: Earn $350 (Expired)Ĭapital One’s 360 Checking account is good for people who want to keep fees to a minimum and don’t need a physical bank location. What is the offer? Earn a $1,000 bonus after a deposit of $100,000 or more from an external account into a new 360 Performance Savings account within 15 days of account opening and keep the money on deposit for at least 90 days.In exchange for that, you’ll be eligible to earn a $1,000 welcome bonus.

The most generous bonus offered on the Capital One 360 Performance Savings Account requires a steep initial deposit of $100,000. Your deposit must be “externally sourced funds,” meaning they come from a source not affiliated with Capital One.Ĭapital One 360 Performance Savings Account Bonus: Earn $1,000 With a $100,000 Deposit (Expired) What is the offer? Earn a $500 bonus after a deposit of $50,000 or more from an external account into a new 360 Performance Savings account within 15 days of account opening and keep the money on deposit for at least 90 days.New customers who open a 360 Performance Savings account and deposit $50,000 or more are eligible for a $500 welcome bonus.

#CAPITOL ONE BUSINESS BANKING CODE#

Use promo code SPRING23 when opening your account.Ĭapital One 360 Performance Savings Account Bonus: Earn $500 With a $50,000 Deposit (Expired)Ĭapital One’s savings account bonus is more generous if you deposit a minimum of $50,000.

Is there an offer code for this promotion? Yes. Is there a time limit on the offer? This is a limited-time offer available to new customers who open an account on or before. Your deposit must be “externally sourced funds,” meaning they come from a source not affiliated with Capital One. What is the offer? Earn a $100 bonus after a deposit of $10,000 or more from an external account into a new 360 Performance Savings account within 15 days of account opening and keep the money on deposit for at least 90 days. The account pays a 4.30% annual percentage yield (APY), a competitive rate when compared to the best savings accounts on the market.

That’s a good deal if you need a place to stash an emergency fund or save for another goal. You can earn a $100 bonus for opening a new 360 Performance Savings account with Capital One.

Use promo code BONUS350 when opening your account.Ĭapital One 360 Performance Savings Account Bonus: Earn $100 With a $10,000 Deposit (Expired)

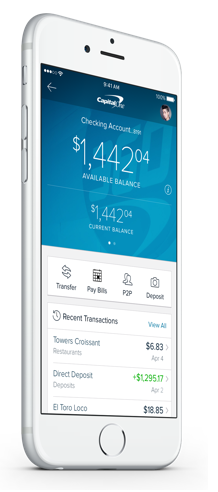

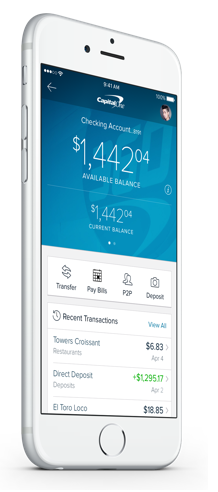

Is there a time limit on the offer? This is a limited-time offer available to new customers who open an account on or before Oct. When do you receive your bonus? Your bonus will be paid within 60 days of meeting the requirements. What is the offer? Earn a $350 bonus after opening a new 360 Checking account and receive at least two qualifying direct deposits of $250 each within 75 days of opening your account. It also gives you the option to access your paycheck up to two days early with its Early Paycheck feature. The 360 Checking account has no fees, minimums or overdraft fees. You can earn a bonus for opening a new 360 Checking account with Capital One. Capital One Promotions for 2023 Capital One 360 Checking Account Bonus: Earn $350 Here are the details on Capital One’s limited-time welcome offers for new customers *. The bonus will be deposited into your account within 60 days of meeting the promotion requirements. You’ll then need to hold that deposit in your account for 90 days after the funding period. You’ll have to open a new account using the promo code and deposit a certain amount of money during the initial 15-day funding period. Capital One offers a relatively competitive and easy-to-earn welcome bonus to new customers opening a 360 Checking account.

0 kommentar(er)

0 kommentar(er)